Understanding the Classification and Regulation of Securities in Switzerland: Navigating the complexities of securities regulation in Switzerland can be challenging, especially with the distinctions between public offerings and private placements, and between certificated and uncertificated securities.

To provide clarity, we’ve created two comprehensive tables that outline the key aspects of these different types of securities and their regulatory requirements under Swiss law. This will help investors, issuers, and financial intermediaries understand the nuances of securities classification, ensuring compliance with the Financial Market Infrastructure Act (FMIA) and the Code of Obligations (CO). Do not hesitate to contact me at connect@swissfintechpro.com for more information on this matter. We will distinguish between Public Offering and Private Placement.

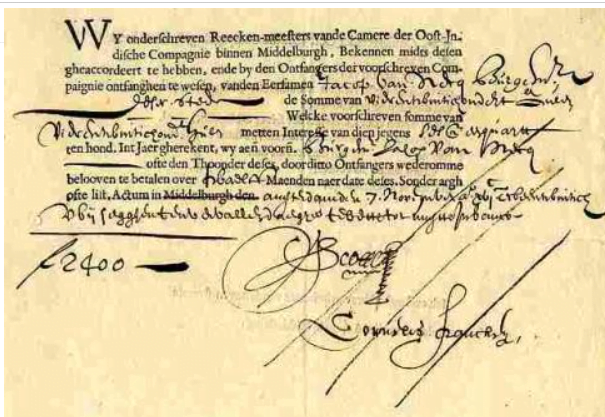

The holder of the share certificated of the Dutch East India Company that serve has featured image of this post was Pieter Harmensz. The share is worth 150 guilders. Dated September 9, 1606, this is the oldest known stock certificate in the world. A Dutch university student named Ruben Schalk discovered it..

Public offerings involve offering securities to the general public, typically through a stock exchange or a DLT (Distributed Ledger Technology) trading facility. These offerings are subject to full regulatory oversight to ensure transparency, investor protection, and market integrity.

Mobile Phone Readers: Pinch-to-zoom In and view the entire table

| Aspect | Certificated Securities (Public Offering) | Uncertificated Securities (Public Offering) |

|---|---|---|

| Public Offering | Yes, offered to the public and traded on an exchange | Yes, offered to the public and traded on a DLT trading facility |

| Standardization | Standardized and identical in structure and denomination | Standardized and identical in structure and denomination |

| Trading | Suitable for mass trading, publicly available | Suitable for mass trading, publicly available |

| Form | Physical share certificates | Digital form, no physical certificate |

| Record-Keeping | Physical or electronic records of ownership | Digital records required (e.g., blockchain) |

| Regulation | Full securities regulations under FMIA | Full securities regulations under FMIA |

| Transferability | Requires physical transfer or endorsement | Transferable via electronic means or blockchain technology |

| Security | Physical possession required for proof of ownership | Ownership verified through digital records |

| Examples | Shares of ABC Corporation traded on the NYSE | Digital shares of ABC Corporation traded on a DLT trading facility |

Private placements involve issuing securities to a select group of investors, typically fewer than 20, without making them available to the general public. These placements may have regulatory exemptions but are still considered securities under Swiss law. They are often tailored for specific investors and not intended for mass trading.

| Aspect | Certificated Securities (Private Placement) | Uncertificated Securities (Private Placement) |

|---|---|---|

| Public Offering | No, issued privately to fewer than 20 investors | No, issued privately to fewer than 20 investors |

| Standardization | Tailored for specific investors, not standardized | Tailored for specific investors, not standardized |

| Trading | Not intended for mass trading, privately held | Not intended for mass trading, privately held |

| Form | Physical share certificates | Digital form, no physical certificate |

| Record-Keeping | Physical or electronic records of ownership | Digital records required (e.g., blockchain) |

| Regulation | Exemptions may apply, but still considered securities | Exemptions may apply, but still considered securities |

| Transferability | Requires physical transfer or endorsement | Transferable via electronic means or blockchain technology |

| Security | Physical possession required for proof of ownership | Ownership verified through digital records |

| Examples | Shares of ABC Corporation issued to 19 private investors | Digital shares of ABC Corporation issued to 19 private investors |

Understanding whether a security is certificated or uncertificated, a public offering or a private placement, is essential for compliance with Swiss securities laws. These tables above serve as quick reference guides to these distinctions. They provide clarity on regulatory requirements and helping stakeholders make informed decisions in the Swiss financial market.

Please also refer to the Financial Market Infrastructure Act (FMIA) and the Code of Obligations (CO). Stay informed and ensure your investments and issuances comply with the relevant legal frameworks. Do not hesitate to contact me at connect@swissfintechpro.com for more information on this matter. We will distinguish between Public Offering and Private Placement.